Press-release №14. Situation on Financial Market in April 2022

- Operations of the National Bank in Monetary Policy

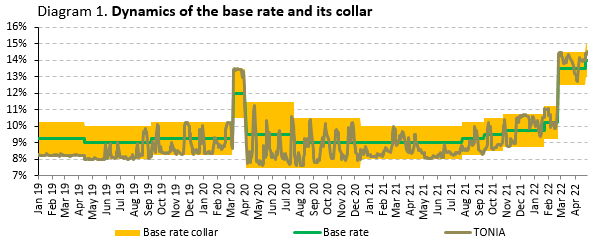

On April 25, 2022, the National Bank increased the base rate by 0.5 p.p., up to 14% p.a., with an interest collar of +/- 1.00 p.p. given rising inflationary pressures.

TONIA[1] indicator, which is a target rate when conducting monetary policy operations in the money market, was formed within the interest rate collar in April 2022. In April 2022, the weighted average value of TONIA was 13.8% p.a. (14.1% in March 2022).

Monetary policy instruments. At the end of April 2022, negative balance of operations of the National Bank (open position of the National Bank) in the money market amounted to 2.3 trillion KZT.

Volume of operations to provide liquidity via reverse repo operations totaled 237.8 billion KZT, volume of withdrawals via direct repo – 70.6 billion KZT.

Volume of liquidity withdrawn through deposit auctions was 534.3 billion KZT, bank deposits with the National Bank – 257.9 billion KZT.

Volume of short-term notes in circulation at the end of April 2022 was 1,734.9 billion KZT, a 21.1% increase for the month.

In April 2022, six auctions of NBK notes were held for a total amount of 1,362.7 billion KZT, including five auctions to place 1-month notes for an amount of 1,302.7 billion KZT (weighted average yield – 13.54%), one auction to place 3-month notes for an amount of 60,0 billion KZT (13.67% yield).

Volume of repayment of short-term notes of the National Bank in April 2022 made 866.9 billion KZT.

- Government securities of the Ministry of Finance of the Republic of Kazakhstan

In April 2022, the Ministry of Finance of the Republic of Kazakhstan made 12 placements of short-term (MEKKAM) and medium-term (MEOKAM) government securities in the amount of 256.7 billion KZT with maturity from 1 year to 5 years. The weighted average yield on them ranged from 12.64% to 13.97% per annum.

Volume of securities of the Ministry of Finance of the Republic of Kazakhstan in circulation in April 2022 rose by 2.2% to 11,398.2 billion KZT. [2]

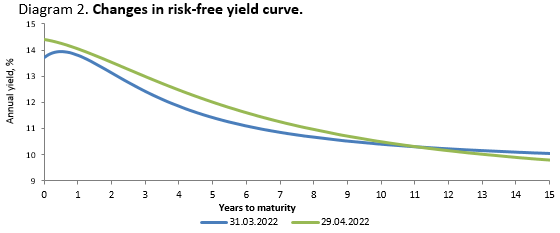

At the end of April 2022, risk-free yield curve[3] rose up relative to the end of the previous month, demonstrating an increase in yield on government securities in the short and medium term, as well as a declining yield in the long-term segment.

Source: KASE

- Foreign exchange market

In April 2022, KZT exchange rate fluctuated within the range of 443.85 – 472.81 USD/KZT. At the end of April 2022, USD/KZT stock exchange rate was 445.62 USD/KZT, having gained 4.6% for the month.

Total volume of transactions in the USD/KZT currency pair for the month totaled USD 11.6 billion, including volume of stock exchange trading on the Kazakhstan Stock Exchange – USD 1.9 billion, volume of operations on the OTC foreign exchange market – USD 9.7 billion. In the overall volume of operations on the OTC market, one subsidiary bank accounted for 70.4% or USD 8.2 billion (78.6% or USD 5.1 billion in March 2022), which was due to hedging their equity capital from currency risks. These transactions are carried out within the bank group and do not affect the ratio of demand or supply of foreign currency in the domestic foreign exchange market.

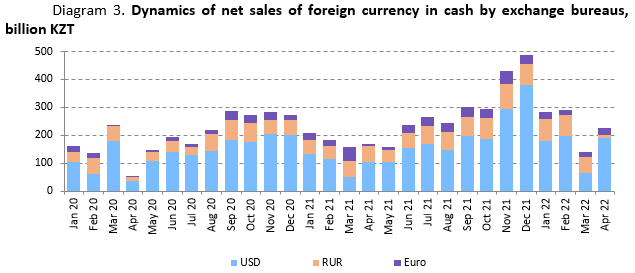

In April 2022, households bought on a net basis foreign currency in cash for an amount equivalent to 226.1 billion KZT. As compared to the previous month, these expenses grew by 1.6-fold (140.6 billion KZT in March 2022), volume of net purchases surged by 32.5% year-on-year (170.7 billion KZT). The bulk of expenses were directed to buy USD – 83.7% or 189.2 billion KZT, Russian rubles – 5.3% or 11.9 billion KZT, Euro – 10.9% or 24.6 billion KZT. By type of currency, spending on USD purchases for the month soared by 2.9 times (a 1.8-fold increase on y/y basis), purchase of the Russian rubles plummeted by 4.9 times (down by 4.9 times on y/y basis) and purchase of Euro rose by 1.5 times (a 2.9-fold growth on y/y basis).

- International Reserves and Monetary Aggregates

Gross international reserves of the National Bank for April 2022, according to tentative data, inched up by 0.8% and totaled USD 33.4 billion.

Foreign currency and gold reserves expanded due to increasing gold portfolio and receipt of funds to accounts of the Ministry of Finance in the National Bank. The gold portfolio widened by more than USD 200 million due to purchase of gold as part of implementation of the priority right. Impact of positive factors was partially offset by an outflow of funds from correspondent accounts of second-tier banks with the National Bank.

International reserves of the country as a whole, including assets of the National Fund in foreign currency (USD 52.5 billion), made USD 85.9 billion at the end of April 2022.

Monetary base in April 2022 shrank by 7.6% and amounted to 9,968.0 billion KZT (it contracted by 9.0% since the beginning of the year). Narrow monetary base, that is, the monetary base excluding fixed-term deposits of second-tier banks with the National Bank, widened by 0.4% to 7,242.4 billion KZT (4.3% since the beginning of the year).

Money supply in April 2022 declined by 1.8% and totaled 28,984.2 billion KZT (by 3.7% since the beginning of the year), cash in circulation expanded by 1.6% up to 3,106.6 billion KZT (by 3.6% since the beginning of the year).

- Deposit Market

Volume of residents' deposits in the depository institutions at the end of April 2022 amounted to 25,877.6 billion KZT, a 2.2% decrease for the month (8.0% growth on y/y basis). Corporate deposits for the month declined by 2.2% to 13,228.7 billion KZT, retail deposits decreased by 2.2%, to 12,649.0 billion KZT.

Volume of deposits in the national currency for the month increased by 0.4%, to 16,772.9 billion KZT, in foreign currency contracted by 6.7% to 9,104.7 billion KZT. Dollarization level at the end of April 2022 was 35.2% (36.0% in December 2021).

Corporate deposits in the national currency in April 2022 rose by 1.2% to 8,450.0 billion KZT, in foreign currency fell by 7.6% to 4,778.7 billion KZT (36.1% of corporate deposits).

Retail deposits in KZT declined by 0.4% to 8,322.9 billion KZT, in foreign currency went down by 5.6% to 4,326.0 billion KZT (34.2% of retail deposits).

Fixed-term deposits totaled 17,190.7 billion KZT, up by 1.3% for the month. In their structure, deposits in the national currency amounted to 11,380.9 billion KZT, in foreign currency – 5,809.8 billion KZT.

Weighted average interest rate on fixed-term deposits in the national currency of non-bank legal entities in April 2022 was 11.6% (7.2% in April 2021), on retail deposits – 10.6% (9.0%).

- Credit Market

Volume of bank lending to the economy at the end of April 2022 stood at 19,399.5 billion KZT with a 0.9% increase for the month (a 28.5% surge y/y). Volume of corporate loans for the month decreased by 0.5% down to 8,016.1 billion KZT, retail loans rose by 1.9% up to 11,383.4 billion KZT.

Volume of loans in the national currency for the month widened by 1.6% to 17,637.6 billion KZT. In their structure, corporate loans rose by 1.0% and retail loans by 2.0%. Volume of loans in foreign currency diminished by 5.6% to 1,762.0 billion KZT. In their structure, corporate loans fell by 5.6% and retail loans by 11.9%. Loans in the national currency accounted for 90.9% at the end of April 2022 (89.7% in March 2022).

Volume of long-term loans for the month grew by 0.5% to 16,047.4 billion KZT, and volume of short-term loans by 3.0% to 3,352.2 billion KZT.

Lending to small businesses in April 2022 declined by 10.9% to 4,039.8 billion KZT (50.4% of the total volume of loans to the corporate sector).

In April 2022, weighted average interest rate on loans issued in national currency to non-bank legal entities was 15.2% (11.6% in April 2021), to individuals – 17.3% (17.3%).

- Payment Systems

As of May 1, 2022, 19 payment systems are operated in the Republic of Kazakhstan, including payment systems of the National Bank, money transfer systems, and payment card systems.

In April 2022, 5.5 million transactions amounting to 55.7 trillion KZT were carried out through the payment systems of the National Bank (Interbank Money Transfer System and Interbank Clearing System) (as compared to March 2022, down by 1.0 % in number, by 6.1% in amount). On average, 261.9 thousand transactions worth 2.7 trillion KZT were made through these payment systems daily.

As of May 1, 2022, 19 banks and Kazpost JSC are issuers of payment cards in the Republic of Kazakhstan. Total number of issued and distributed payment cards amounted to 58.6 million cards. In April 2022, 50.7% of payment cards (29.8 million payment cards) were used for non-cash transactions and/or cash withdrawals.

In April 2022, 669.9 million transactions were carried out for an amount of 9.3 trillion KZT using payment cards of Kazakhstan's issuers (compared to March 2022, the number of transactions decreased by 1,6%, amount – 5,7%). The volume of non-cash payment transactions by number of transactions using payment cards of Kazakhstan’s issuers accounted for 96.7% (647.5 million transactions). Volume of non-cash transactions for the same period accounted for 80.2% (7.4 trillion KZT).

In April 2022, the total volume of money sent via international money transfer systems was 0.32 million transfers in the amount of 113.1 billion KZT. Volume of money transfers rose by 21.4% as compared to March 2022. In the total volume of sent transfers, 79.1% of the total number (0.26 million transactions) and 91.6% of the total amount (103.6 billion KZT) of transactions were sent outside Kazakhstan. In Kazakhstan, 20.9% of the total amount (0.07 million transactions) and 8.4% of the total amount (9.5 billion KZT) were made via money transfer systems. Through international money transfer systems 0.18 million transactions in the amount of 52.5 billion KZT were received from abroad.

- Pension System

Pension savings of contributors (recipients) as of May 1, 2022 totaled 12,939.5 billion KZT, having decreased in April 2022 by 40.0 billion KZT or by 0.3%.

In April 2022, net income from investment of pension assets declined by 170.1 billion KZT down to 7,033.2 billion KZT as of May 1, 2022.

Number of individual pension accounts of contributors for compulsory pension contributions (given individual pension accounts that do not have pension savings) as of May 1, 2022 totaled 10.9 million accounts.

Amount of pension payments in April 2022 was 34.6 billion KZT.

As of May 1, 2022, the bulk of UAPF total investment portfolio account for government securities of the Republic of Kazakhstan and non-government securities of Kazakhstan’s issuers (41.2% and 22.5% of the total volume of pension assets, respectively).

- Monitoring of Enterprises for Quarter I 2022

According to results of monitoring of enterprises, the real sector demonstrates continued positive dynamics of economic activity, due to an increasing demand for final products. Along with that, prices for final products, raw materials and materials continue to rise.

Demand for final products of enterprises slightly rose, diffusion index (hereinafter ‘DI’) grew from 52.0 to 53.1. Improved indicator is reported in the sectors of production of goods (54.1) and services (52.2).

The growth rate of final products’ prices of enterprises in the economy slightly accelerated, DI made 65.2. In the second quarter of 2022, enterprises expect a slowdown in growth of prices for final products.

[1] A weighted average value of yield of one-day repo operations with securities of public stock basket with a 5% cut of transactions with the lowest and highest yield.

[2] Outstanding KZT public stock (excluding public stock in foreign currency).

[3] To plot the yield curve was used the method of the yield function determination of public stock of the Republic of Kazakhstan, posted on an official website of the Kazakhstan Stock Exchange.

For more details mass media can contact

+7 (7172) 775 210

e-mail: press@nationalbank.kz

www.nationalbank.kz