1. Measures of Financial Openness

|

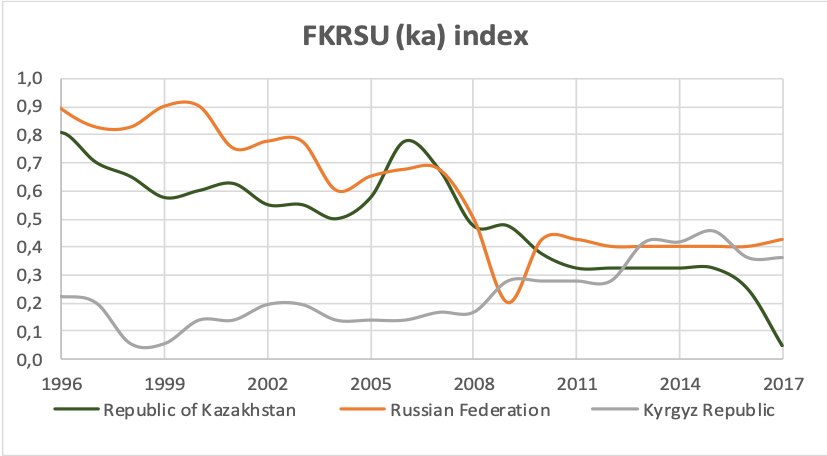

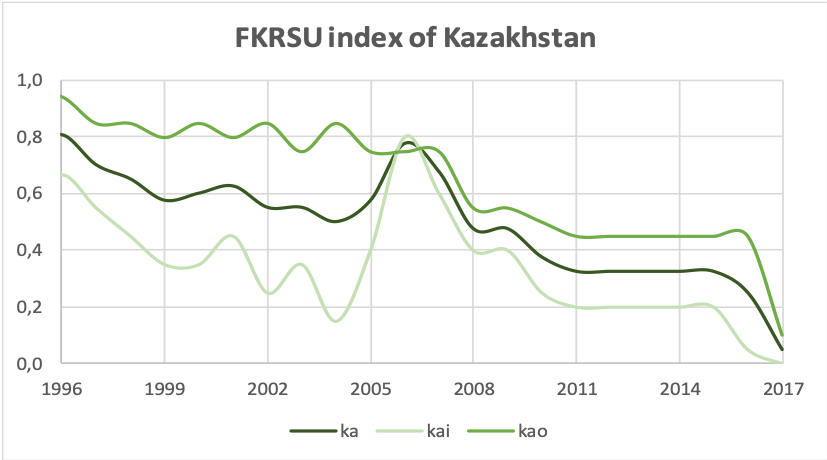

The FKRSU Index: Fernández, Klein, Rebucci, Schindler and Uribe (de jure) The index is based on the introduction of codes in the text of the AREAER report. The data set consists of 10 categories of assets, money market instruments, debt securities, equity securities, collective investment securities, financial loans, derivatives, commercial loans, guarantees, real estate transactions and direct investments. The FKRSU index consists of indixes of average values of general restrictions (ka), restrictions flow (kai) and restrictions outflow (kao) of assets. An index value closer to 1 indicates the presence of a restriction, and 0 indicates the absence of a restriction. The FKRSU Index of Kazakhstan shows no restrictions of capital flows (kai). Source: Fernandez, Klein, Rebucci, Schindler and Uribe (2015) http://www.columbia.edu/~mu2166/fkrsu/

|

|

|

|

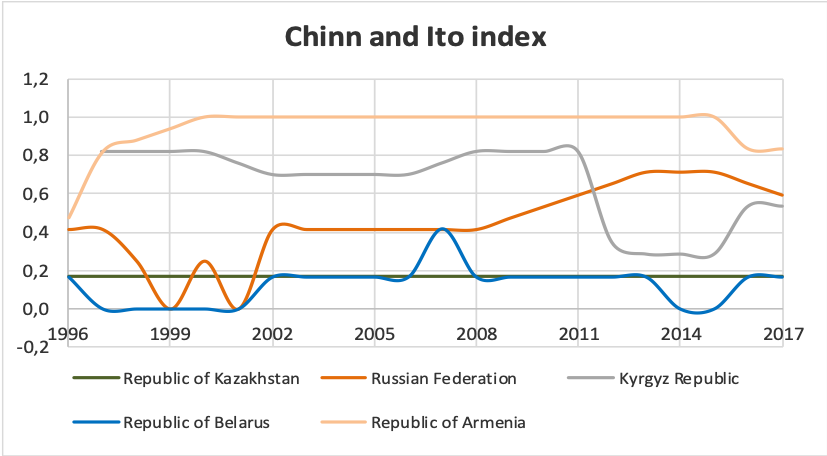

The Chinn and Ito Index (de jure) The Chinn Ito Index measures the extent of openness in capital account of a country transactions. A value 1 indicates no restriction and a value 0 indicates restrictions. Source: Menzie D. Chinn, Hiro Ito (2007) |

|

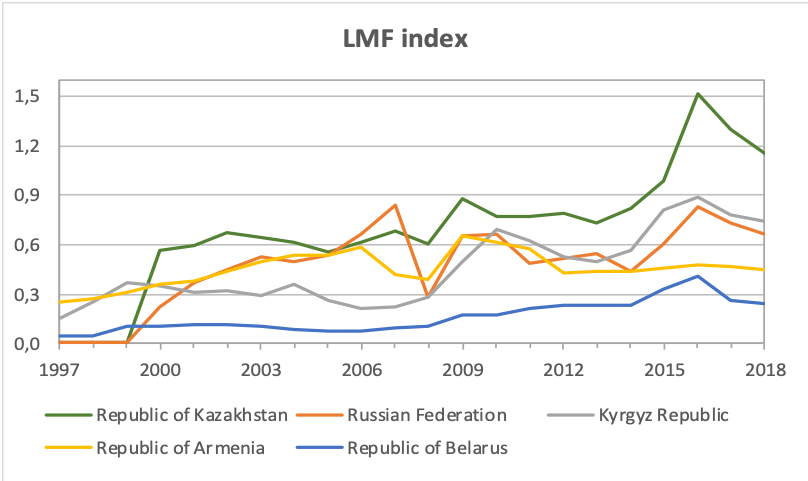

The Lane and Milesi-Ferretti (LMF) Index (de facto) The financial integration index is calculated as the ratio of the sum of direct investments (assets), portfolio equity instruments (assets), direct investments (liabilities) and portfolio equity instruments (liabilities) to GDP. The higher the index value, the higher the extent of financial integration. The LMF index of Kazakhstan, in comparison with the EAEU countries, is more financially integrated. Source: http://data.imf.org/regular.aspx?key=61545851 |

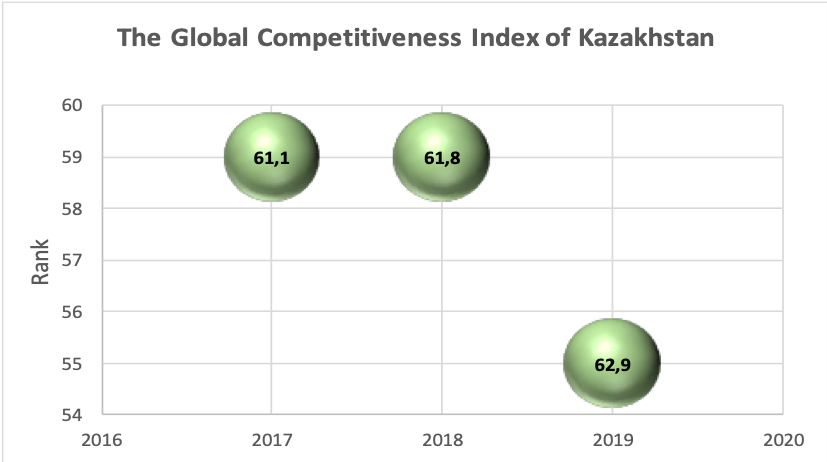

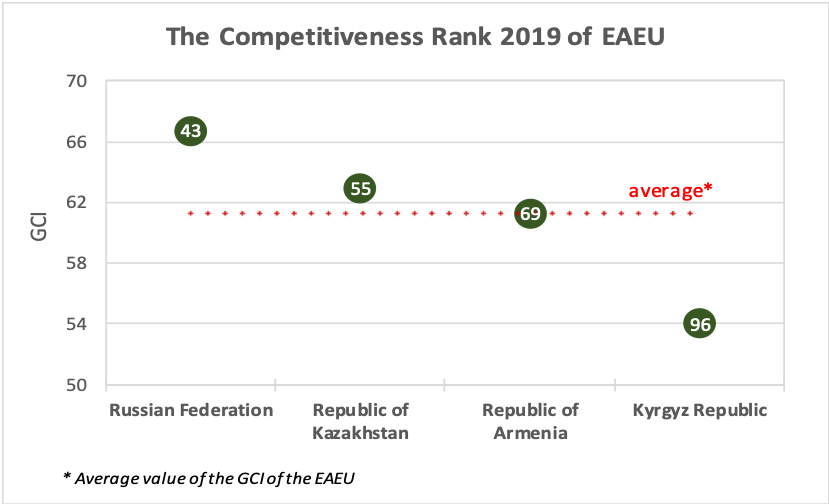

2. The Global Competitiveness Index

|

The World Economic Forum defines competitiveness as the ability of a country and its institutions to ensure stable economic growth. The Global Competitiveness Index (GIC) of the World Economic Forum is calculated on the basis of 103 indicators obtained on the basis of a combination of data from international organizations and a survey of company executives. The indicators are structured into 12 categories (pillar): institutions, infrastructure, ICT adoption, macroeconomic stability, health, skills, product market, labor market, financial system, market size, business dynamism, innovativon caoability. According to the results of the Global Competitiveness Report 2019, Kazakhstan has ranked at the 55th place (among 141), improving its rank by 4 points Source: www.weforum.org

|

|