Open API, Open Banking

The concept of Open API and Open Banking development in the Republic of Kazakhstan for 2023-2025.

To continue the systematic and step-by-step development of digital transformation in the financial sector with a focus on ensuring technological advancement and consumer rights protection, the National Bank of the Republic of Kazakhstan, in collaboration with the Agency for Regulation and Development of Financial Market and with participation of the Agency for Protection and Development of Competition, has developed and approved the Concept for the Development of Open API and Open Banking in the Republic of Kazakhstan for 2023–2025.

Open Banking allows banks to provide third parties with access to their customers’ data exclusively with the customers’ consent, thereby enhancing convenience and speed of service. For instance, in banking services, open APIs enable customers to manage multiple accounts, make regular payments and transfers, optimize financial reporting, conduct income and expenditure analysis, and much more.

The implementation of Open Banking is based on the use of Open API technology, which is a globally recognized protocol for information exchange.

As part of the development of the Concept, the regulators NBRK, ARDFM, and APDC held preliminary discussions with second-tier banks. The current status of API technology usage among second-tier banks has been clarified, and an assessment of the infrastructure and regulatory foundations for the implementation of open banking services has been conducted.

The development of this digital area within the financial sector promotes the emergence of new financial services and products, as well as business models resulting from collaboration between second-tier banks and other payment service providers based on Open APIs.

Launch of the first pilot project in 2023

As part of the strategic plan for the phased implementation of the Open Banking Concept, the key stages of the Pilot Project scheduled for 2023 have been achieved and implemented. The Pilot Project for the scenario “Exchange of information on the client’s current accounts” was launched on November 1, 2023, with the participation of:

- second-tier banks;

- focus group with a limited number of real customers from participating banks, consisting of 128 people.

During the Pilot Project, according to the operational model, participating banks were connected to the Open API platform, allowing them to publish their developed APIs and integrate with APIs of other participants after the necessary verifications. Acting as API users those banks successfully enhanced their mobile applications, providing focus group participants with the ability to view their accounts data at other participating banks and manage their data sharing consents. Three mobile applications from banks (IOS/Android) were tested by the focus group.

The implementation of the Pilot Project has demonstrated significant and practical results, thereby confirming specific hypotheses regarding the development and adoption of open banking:

- performance and scalability of the technological infrastructure,

- security and compliance with information security requirements,

- feasibility of the technology and the validation of Open API,

- easy access for participating banks to connect to the platform,

- user-friendly design of the platform’s user interface and consent management system.

The Pilot Project on Open Banking in Kazakhstan has yielded important findings that underscore the significance and success of this concept in the context of modernizing the country’s financial sector. Detailed information is provided in the published report titled “Open API and Open Banking: Results of the Pilot Project”.

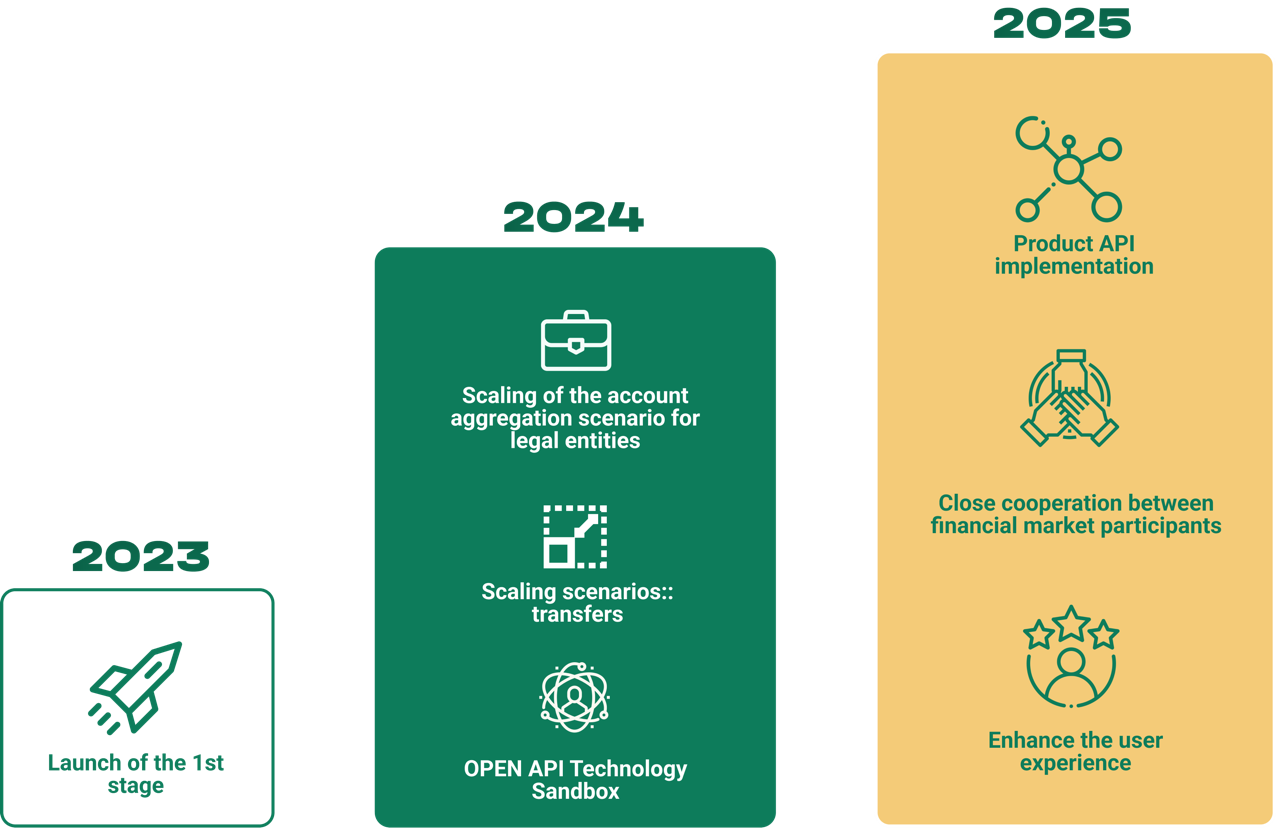

Conclusions and further steps for the development of Open API and Open Banking for the years 2023–2025

The results of the Pilot Project have confirmed that Open Banking is indeed an integral part of modern user requirements and, at the same time, provides the foundation for the active development of the financial market.

For the full realization of the concept’s potential, comprehensive and phased implementation of the following scenarios is required. Key strategic directions for scaling have been identified as a result of the successful project implementation and evaluation. These strategic milestones aim to expand functionality and increase market participation. The main scaling stages for 2024 are as follows.

- Scaling of the account aggregation scenario:

- inclusion of the other market participants in the account aggregation process,

- development of account aggregation scenarios, adapted for use by legal entities.

- Expansion of business case standards:

- expansion of business case capabilities, including the development and implementation of a scenario for initiating transfers between accounts of a single system participant (Me2Me),

- implementation of the scenario for transfers between accounts of different system participants (C2C), which promotes broader interaction among market participants.

- Creation and implementation of the Open API technology sandbox, which is a collaborative platform that provides market participants with access to open application programming interfaces. This platform serves as a kind of ‘sandbox’ where various participants are able to test and refine their ideas, thereby contributing to the creation of innovative solutions in the field of financial technology.

In 2025, there are plans for further expansion of functionality and deeper interaction within the open banking framework in Kazakhstan. One of the key directions for development will be the expansion of business scenarios to the level of product-oriented Open APIs. This involves the integration of more complex and diverse products and services, facilitating a deeper digital transformation in the financial sector.

These strategic scaling directions, including the expansion of business scenarios to product-oriented Open APIs, are aimed at creating a more flexible and innovative financial ecosystem in Kazakhstan. They provide an opportunity for various market participants to offer and utilize new products and services through Open Banking APIs, thereby fostering the development of the digital economy in the country.