Review of Certain Emerging Market Currencies as of July 23 – 30, 2021

Following July 30 trading, the official exchange rate of KZT made 424.44 KZT/USD, gaining 0.1% of its value for a week (from 424.68).

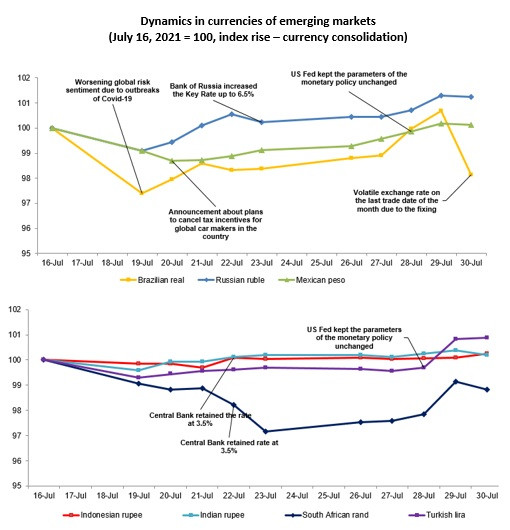

Between July 23 and July 30, 2021 currencies of the emerging markets demonstrated versatile dynamics in the foreign exchange market. At the beginning of the week, emerging market currencies were under pressure from a drastic devaluation of Chinese shares and the yuan amid speculations and concerns about regulatory restrictions on US investors to invest in China but later the negative was offset by comments of the US Fed Chairman about his readiness to use all the tools to support the economy. The US Fed kept parameters of monetary policy unchanged (the target range for the federal funds rate within 0 – 0.25%), highlighting progress towards conditions for winding up the asset purchase program, while a decision on a timeframe of such reduction has not yet been made. US GDP rose 6.5% YoY in 2Q 2021, which turned out to be worse than economists forecasted.

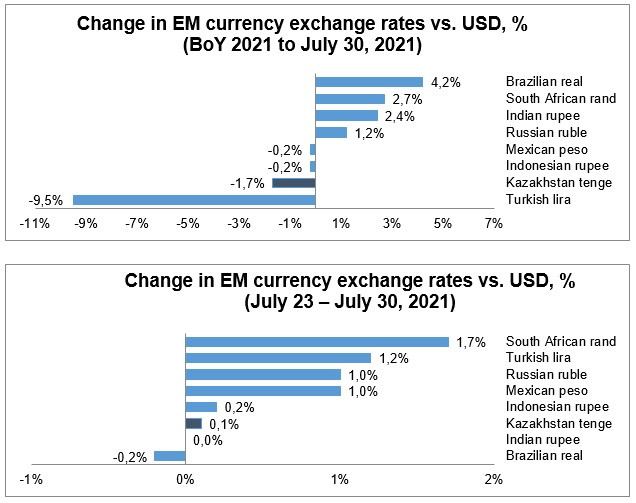

The exchange rates for currencies of emerging markets demonstrated the following dynamics against the USD:

- South African rand gained 1.7% (from 14.85 to 14.6) after a meeting at the US Fed and Powell’s comments about a need to keep on buying assets until a significant further progress;

- Turkish lira gained 1.2% (from 8.55 to 8.45) amid data about a growing number of tourists and shrinking deficit of trade balance in June to (-)2.85 billion from (-)4.1 billion in May;

- Russian ruble gained 1% (from 73.91 to 73.17) against the background of growing oil prices (+3% for a week);

- Mexican peso gained 1% (from 20.07 to 19.87) amid global weakening of the USD exchange rate after a meeting at the Fed;

- Indonesian rupee appreciated by 0.2% (from 14 493 to 14 463) against the background of sales of currency proceeds by exporters at the end of month;

- Indian rupee for a week almost stayed put falling from 74.41 to 74.42;

- Brazilian real lost 0.2% (from 5.2 to 5.21) against volatility and low liquidity on the last trade day of a month (against the background of purchases by traders of foreign currency before fixing was formed).

More detailed information for the media representatives is available upon request:

More detailed information for the media representatives is available upon request:

+7 (7172) 775 201

e-mail: press@nationalbank.kz

www.nationalbank.kz