Press release № 9. On balance of payments current account forecast

Initial assumptions

The base scenario for the current forecast is the price of Brent crude oil at $60 per barrel starting from February 2019 (the average price in 2019 is $60; in 2020 – $60).

In comparison with the previous forecast round, some initial assumptions of the forecast are revised.

Oil and gas condensate production volumes are revised downwards: to 89.5 million tons in 2019 (previous forecast – 90 million tons) and 90 million tons in 2020. The downgrade in projections is due to temporary suspension of operation at 3 large oil production fields (Tengiz, Kashagan, Karachaganak) due to repairs.

The real GDP growth rate projections remain almost unchanged compared to the previous forecast round. Some slowdown in real GDP growth is expected compared to 2018 driven by reduction in the production of oil and gas condensate in the forecast horizon.

Expectations on external demand are revised downwards: a slightly greater slowdown in the growth rates of the economies of the Eurozone and China is expected compared to the previous forecast round.

Forecast

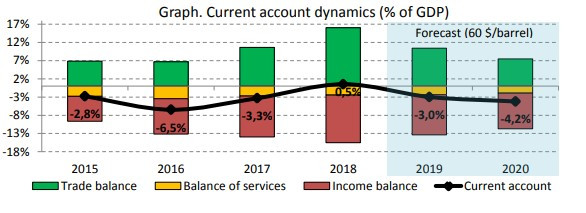

The current account in Kazakhstan is determined by the dynamics of the trade balance and income balance. The dynamics of the balance of services is stable and its impact on the current account indicators is limited (Graph).

In 2019 the current account is expected to deteriorate to (-)3.0% of GDP compared to 2018 (previous forecast – (-)3.9% of GDP). The improvement in the forecast for 2019 is mainly due to the reduction in the income balance deficit.

In 2020 the current account deficit will increase to (-)4.2% of GDP. The growth of the deficit in the forecast horizon is due to decline in oil prices, the expected reduction in oil and gas condensate production and moderate increase in import of goods.

Export of goods. In 2019, export is expected to decline by 15.8% (y/y) (previous forecast – (-)8.8% (y/y)) to $52.2 billion. The change in forecast is due to oil prices and downward revision of expectations on oil production. The lowering of the forecast is also associated with slightly larger slowdown in the growth rates of the economies of the Eurozone and China compared to the previous forecast round. In 2020, export of goods is expected to decrease by 2.3% (y/y) and amount to $51.0 billion.

Import of goods. Import of goods in 2019 is expected to remain almost the same (+1% (y/y)) compared to 2018 and amount to $34.8 billion (previous forecast – $36 billion). In 2020 import is expected to reach $37.4 billion (+7.6% (y/y)). Lower import compared to the previous forecast is due to the assumption that the imposed ban of the Ministry of Energy of the Republic of Kazakhstan on the import of gasoline from Russia by rail will continue until the end of 2020.

Consumer imports will be supported by the growth of individuals’ disposable income due to the growth of the minimum wage and social benefits, income tax rate reduction for certain categories of employees, as well as the volume of new consumer loans.

Intermediate and investment imports will grow due to the implementation of government programs2 and investment projects3 , mainly in the oil and gas sector.

Income balance. In the forecast period, the income balance deficit is expected to reduce to (-)$18.5 billion in 2019 and (-)$17.7 billion in 2020. The current forecast trajectory of the income balance is slightly better than the forecasts of the previous review. This is due to the slowdown in the growth of income of foreign investors in the commodity sector of the economy of Kazakhstan in the 2 nd half of 2018 and reduction in expected oil production in the forecast horizon.

The main risks of the forecast are the discrepancy between the actual and scenario oil prices and the volumes of its production, the acceleration of the pace of investment projects, as well as the behavior of foreign direct investors in terms of income accrual. The lack of complete information on the expected investment and economic effects4 can also lead to change in the trajectory of the current account forecast.