Press release №8. On inflation forecast

On March 1, 2019 the National Bank of Kazakhstan completed forecast round "FebruaryMarch 2019". The forecast period covers period from Q1 2019 to Q3 2020.

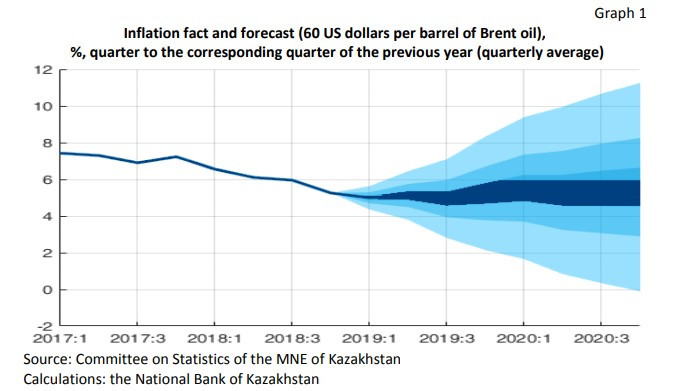

The National Bank of Kazakhstan has considered the price of Brent oil being 60 US dollars per barrel as a baseline scenario for the whole forecast period.

Compared to the previous forecast round, the risk profile as a whole did not change significantly with the exception of some weakening of external risks. In particular, the risk of a fall in oil prices against the background of their stabilization and the risk of outflow of capital from developing markets in the context of softer rhetoric of the US Federal Reserve decreased. At the same time, it is worth noting the high level of inflation risks from consumer demand and fiscal impulse.

According to forecasts, taking into account internal and external assumptions of the forecast, in 2019, annual inflation will be within the targeted corridor of 4-6% (graph 1). Compared with the previous forecast round "November-December 2018", in 2019 the inflation trajectory was adjusted downward.

According to estimates, in 2020 the realization of pro-inflationary risks is possible. Firstly, the positive effect of reduction of tariffs on regulated services on inflation will be exhausted. Secondly, the growth in consumer demand associated with fiscal stimulus will continue. In addition, the dynamics of world food inflation will affect the growth of food inflation in Kazakhstan in the forecast period.

In the forecast period, the output gap will remain in the positive zone, as a result, additional inflationary pressure on consumer prices will be observed. In the medium term, the positive output gap will narrow, approaching zero by the end of the forecast period.

In 2019-2020, real GDP growth in Kazakhstan will slow to a level close to its potential. Forecasts for GDP growth have not changed significantly compared with the previous forecast round. The factors that determine the dynamics of economic activity in the short and medium terms will not vary significantly. In 2019-2020, real GDP growth will slow slightly to below 4%. The key growth driver will be domestic demand against the background of increasing consumer and investment demand. The economy will also be stimulated by a weakly positive fiscal impulse in 2019-2020, which is associated with an increase in budget expenditures on increase of wage, pensions, benefits and other social measures. Net exports will constrain growth in the forecast period due to slower export growth.

More detailed information on the results of the forecast round "February-March 2019" will be published in the "Inflation Report. March 2019" on the official internet-resource of the National Bank of Kazakhstan.