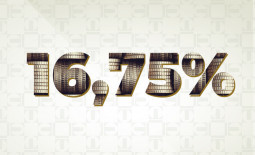

The base rate remains unchanged at 16.75%

The Monetary Policy Committee of the National Bank of the Republic of Kazakhstan has made a decision to maintain the base rate at a level of 16.75% per annum with a corridor of +/- 1 percentage point.

Global inflationary pressures are easing, but inflation remains persistent in some countries. Due to this, central banks in developed countries continue to tighten monetary conditions. In Kazakhstan, inflation is also slowing down both on an annual and monthly basis.

The overall risk balance remains weakly biased towards disinflationary factors, primarily due to the easing pressure from the external sector. However, the modest deceleration of core inflation and rising inflation expectations require a cautious approach to implementing monetary policy. In line with previous communications from the National Bank, the slowdown in inflation is beginning to create space for gradual reduction of the base rate in the future. In this regard, in the next decision based on the forecast round, the National Bank will assess the feasibility of a prudent decrease in the base rate.

The annual inflation rate remained within the forecast range and amounted 14.6% in June 2023. Monthly inflation resumed a downward trend in May and slowed down to 0.5% in June. Indirect effects from the increase in fuel prices have not been observed yet. However, the modest deceleration in core inflation indicators demonstrates the persistence of stable demand in the economy.

Inflation expectations continue to accelerate despite the slowdown in inflation. Expected inflation one year ahead in June reached 17.2% (compared to 17% in May). Perceived inflation in June remained elevated at 18.8%. The observed increase in inflation expectations is a predictable response to the rise in prices for fuel and lubricants, and housing and utilities services.

External inflation continues to slow down but remains stable. This is happening due to declining global prices for food and energy resources. However, due to the persistence of inflation and expectations of its prolonged elevation above target levels, some central banks continue to tighten monetary conditions. The rhetoric of the US Federal Reserve and the European Central Bank has become more stringent, signaling further increases in key interest rates. The policies of regulators have increased concerns about a global recession amid the observed slow recovery of the Chinese economy and put pressure on oil prices. The oil market experiences volatility, resulting in the current oil price settling below the baseline scenario level of $82 per barrel on average for 2023.

The trajectory of economic growth aligns with the National Bank's forecast. From January to May 2023, the economy of Kazakhstan expanded by 4.5%. The main contributors to GDP growth were increased construction activity, including infrastructure projects, growth in trade, as well as information and communication sectors. Domestic consumer demand remains resilient amid high inflation expectations and steady growth in consumer credit. This is evidenced by the dynamics of retail turnover and significant growth in the import of consumer goods.

Pro-inflationary risks primarily stem from internal factors. Inflation expectations remain high and volatile, indicating an elevated pro-inflationary environment in the country. Price pressures within the country persist due to the reinforcement of fiscal stimulus. External risks are associated with the possibility of a slower inflation slowdown globally and increased uncertainty. This calls for a prudent approach to conducting monetary policy.

The current level of the base rate will help support the slowdown in inflationary processes, partially offset the growth in government expenditures, and prevent anchoring of inflation expectations at high levels. As noted in the communications from the National Bank regarding the previous decision, the observed deceleration of inflation is starting to create space for a gradual reduction in the base rate. In this regard, in the next decision based on the forecast round, the National Bank will assess the feasibility of a prudent reduction in the base rate. The decisions of the National Bank will aim to maintain the base rate at a level conducive to the steady achievement of the inflation target of 5% in the medium term.

The next scheduled decision of the Monetary Policy Committee of the National Bank of the Republic of Kazakhstan on the base rate will be announced on August 25, 2023, at 12:00 Astana time.

More detailed information for the mass media representatives is available upon request:

+7 (7172) 775 210

e-mail: press@nationalbank.kz

www.nationalbank.kz