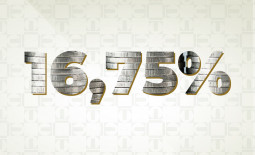

The base rate was raised to 16.75%

The Monetary Policy Committee of the National Bank of Kazakhstan has decided to raise the base rate to 16.75% with a band of +/- 1 p.p. The current decision was based on forecasts and analysis of actual data. It was based on external factors in the form of uncertainty of the geopolitical situation and its consequences, as well as continuing high food prices in the world. On the side of the domestic economy there are historically maximum inflationary expectations, imbalance of supply and demand, as well as restructuring of trade with the accelerated growth of imports.

The National Bank has approached the completion of the monetary policy tightening cycle. The achieved level of a base rate is assessed as a sufficiently high. Maintaining the base rate at the current values for a long period of time will stabilize inflation and gradually reduce it in the medium term. The probability of further tightening of monetary policy in the absence of new pro-inflationary shocks is assessed as low.

Inflation is formed at high levels. In November, the annual inflation rate amounted to 19.6%, demonstrating growth in all components. Monthly inflation slowed somewhat in November, but still remained high, significantly exceeding multi-year averages. This was due to high external inflation with steady domestic demand and the ongoing reorientation of supply chains of consumer goods imports to new trade routes. In this environment, inflationary expectations of households and businesses, which remain near historic highs, and rising consumer lending serve as reinforcing pro-inflationary factors. In an environment of supply chain disruptions, unanchored inflationary expectations stimulate consumption of both nondurable and durable goods.

On the external side, the pro-inflationary factors of the external environment are expected to soften in the medium term as a result of suppressed global demand due to the widespread tightening of monetary conditions. An additional factor of gradual reduction of inflationary pressure is a good grain harvest. At the same time, the level of food prices in general will remain high. The ongoing military conflict in Ukraine is a risk factor.

Taking into account the above-mentioned factors, the inflation forecast was revised. In the baseline scenario, annual inflation in the current year is projected to be in the range of 20-21%. According to estimates, annual inflation is projected to peak in Q1 2023. As a result of the ongoing structural adjustment of trade with high inflationary expectations and a disinflationary external environment, the inflation forecast for 2023 is raised to 11-13%. In 2024, as a result of growing domestic demand and a slower decline in expectations, inflation is projected to be in the 7-9% range. This inflation trajectory is expected, given that as the inflationary backdrop softens and grain prices remain stable, inflation expectations will decline and consolidate at a historically average level. This will allow inflation to reach the target in the future.

In the dynamics of economic growth, despite the overall slowdown, the main sectors of the economy, with the exception of the mining sector, have grown faster this year. The decline in output in the mining sector is due to repairs at the fields, as well as logistics disruptions. GDP growth this year is expected to be in the range of 2-3%, with a further acceleration to 3-4% in 2023. This is due to weaker external demand, more moderate oil production than previously expected, and occasional problems with the delivery of Kazakh exports to world markets. Going forward, GDP growth is projected to stabilize near potential. The main drivers will be growth in exports due to increased oil production, as well as increased investment with moderate demand from households. Fiscal policy will still be in the stimulative zone next year, but the momentum will weaken as a result of the budget rule over the medium term. This will support government consumption and domestic demand. Further economic growth will be constrained by rising imports.

Risks to the inflation outlook are associated with uncertainty about the effects of geopolitical tensions and the development of these tensions, the duration of the trade restructuring period, high and volatile inflation expectations, and the persistence of high food inflation.

Taking into account the inflation forecast, the National Bank has approached the end of the monetary policy tightening cycle. The achieved level of the base rate is assessed as rather high. Maintaining the base rate at the current values for a long period of time will stabilize inflation and gradually reduce it in the medium term. The probability of further tightening of monetary policy in the absence of new pro-inflationary shocks is assessed as low.

The key parameters of the forecast are given in the appendix to the press release. More complete information about the factors of the decision and the forecast will be published in the Report on Monetary Policy on the official website of the National Bank on December 12, 2022.

The next scheduled decision of the Monetary Policy Committee of the National Bank of Kazakhstan on the base rate will be announced on January 13, 2023 at 14:00 Astana time.

More detailed information for the mass media representatives is available upon request:

+7 (7172) 775 210

e-mail: press@nationalbank.kz

www.nationalbank.kz

Appendix

Main parameters of the forecast of the National Bank of the Republic of Kazakhstan under the baseline scenario

|

|

2022 |

2023 |

2024 |

2025 |

|

Forecast conditions |

||||

|

Brent crude oil price, USD per barrel on average for the year |

101,8 |

90 |

85 |

79 |

|

Forecast |

||||

|

GDP |

2-3 |

3-4 |

3,5-4,5 |

3,5-4,5 |

|

CPI |

20-21 |

11-13 |

7-9 |

4-6 |

|

Current account, Bln. USD |

6,4 |

1,9 |

1,2 |

0,6 |