Forecasting and Policy Analysis System at the National Bank serves the purpose of providing information and analytical support for decision-making in monetary policy.

The system includes the process of developing short- and medium-term forecasts of macroeconomic indicators to assess current economic conditions and the future prospects

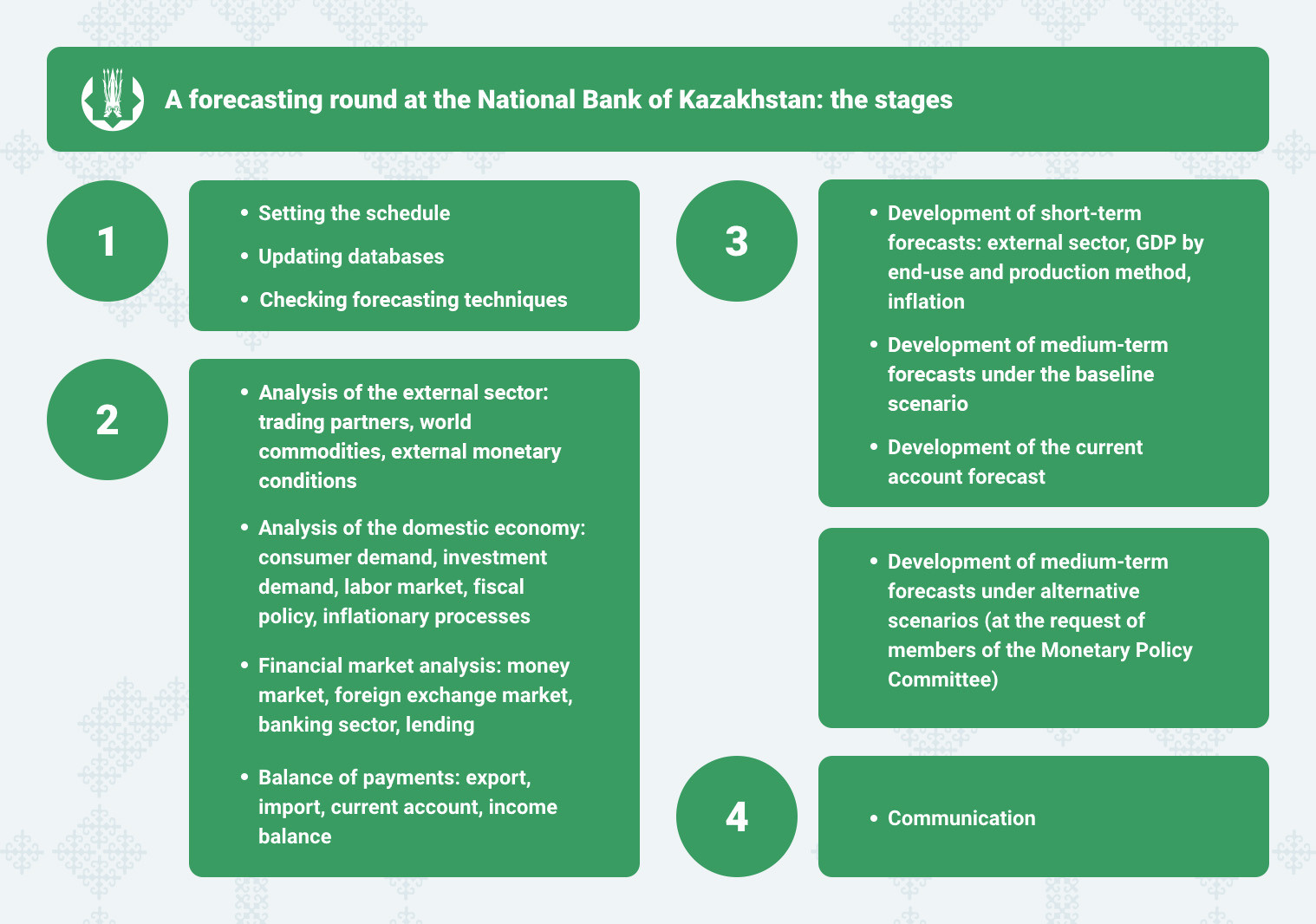

The forecast is conducted four times a year. The timing is set according to release of statistical information. The process of updating data and preparing the analysis is referred to as a forecasting round.

Forecasting

A short-term forecast using econometric techniques includes:

- forecast of inflation and its components,

- forecast of GDP by the method of end-use and method of production,

- external prerequisites: movement of oil prices, economic conditions in the major trading partners, the trajectory of the FAO index.

Short-term forecasts are developed for 2–3 quarters ahead.

The short-term forecast is carried out using econometric techniques, including:

- a combined forecast of monthly inflation including auto regression with a linear trend,

- a random walk model with drift,

- a factorial autoregressive model with distributed lags,

- the BVAR model,

- GDP forecast by bridge equations, dynamic factor models, and the MIDAS methodology.

The results obtained are used to implement medium-term forecasting.

Medium-term forecasts are built to cover for 4–6 quarters ahead. The medium-term forecast is based on the Quarterly Projection Model (QPM), which models the economic cycle in Kazakhstan by analyzing gaps.

The QPM is a simplified version of the structure of the economy of Kazakhstan. All equations in the model are log-linearized whereas the variables are represented as deviations from their potential levels.

The QPM comprises three blocks:

- the inflation processes block

- the output gap block

- the monetary policy block

All econometric models are subject to ongoing revision, which ensures adequacy to the developments in the structure of economy and emerging modeling techniques. Both primary and auxiliary modeling techniques are utilized.

Forecasts of macroeconomic indicators under various scenarios which are prepared within the framework of forecast rounds shall be submitted to the Monetary Policy Committee.

The National Bank publishes the main forecast indicators in a press release covering the decisions on the base rate. The forecasts according to the baseline and alternative scenarios of economic development are covered extensively and available to public in the Monetary Policy Report of the National Bank.

See also: